prince william county real estate tax due dates 2021

Yearly median tax in Prince William County. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

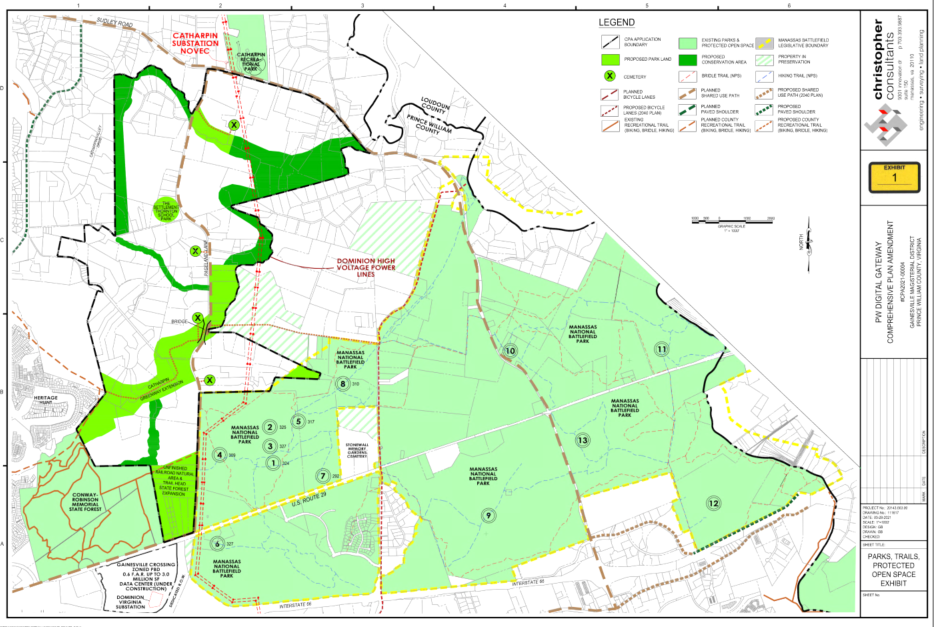

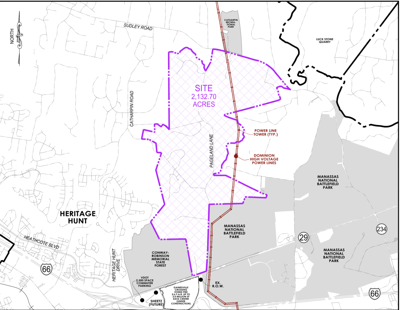

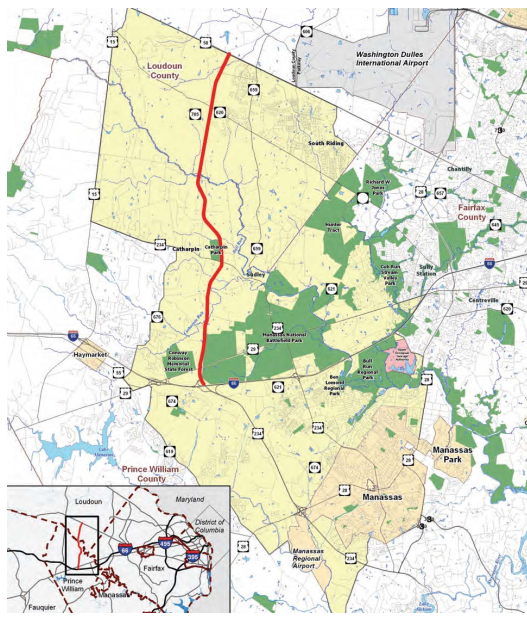

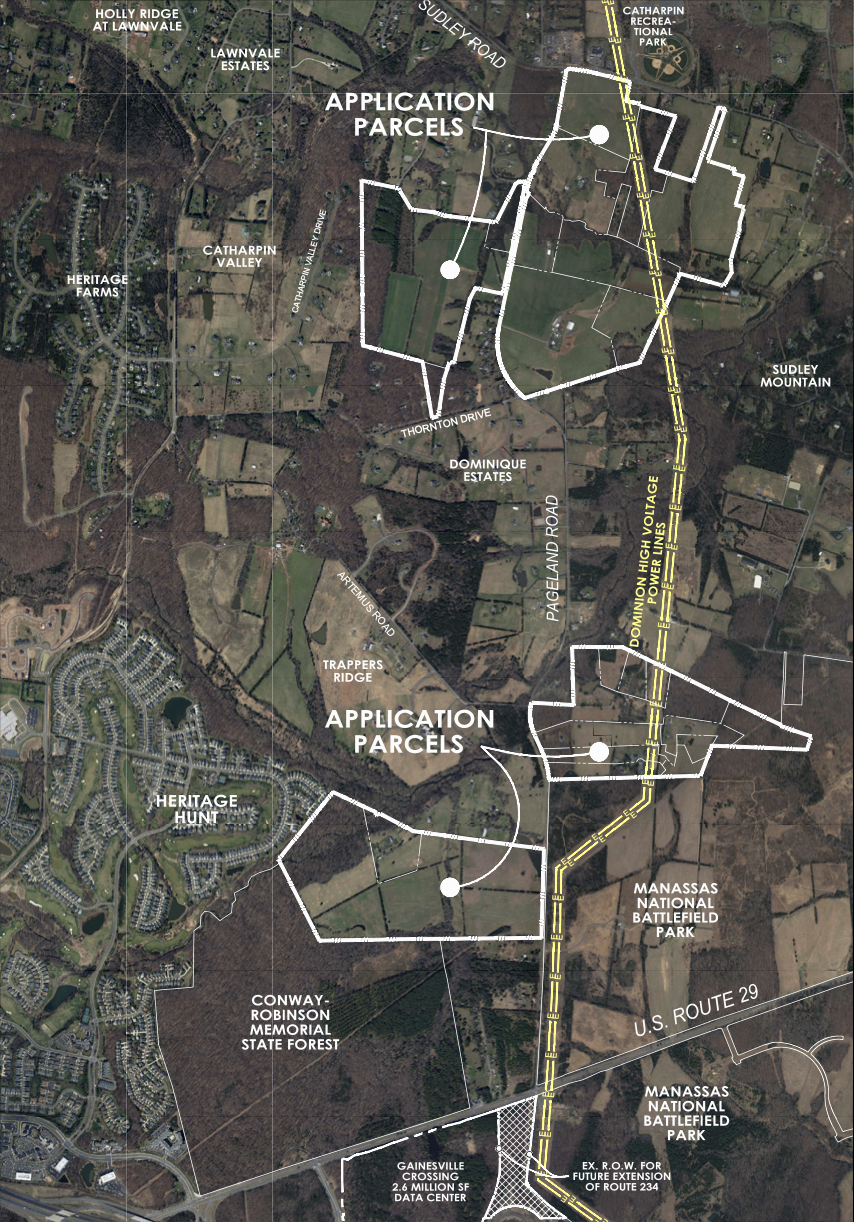

Prince William County Considers Land Use Changes That Encourage Sprawl The Piedmont Environmental Council

Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

. Second-half Real Estate Taxes Due. Prince William County real estate taxes for the first half of 2020 are due on July 15 2020. First Half Real Estate Taxes Due Treasurers Office June 15.

All you need is your tax account number and your checkbook or credit card. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. The 2022 first half real estate taxes were due July 15 2022.

Payment by e-check is a free service. There are several convenient ways. Personal Property Taxes Due Real Estate Taxes Due.

A convenience fee is added to payments by credit or debit card. The real estate tax is. Houses 2 days ago prince william county is located on the potomac river in the commonwealth of virginia in the united.

16 2022 PRNewswire -- In October 2021 PwC announced the sale of its global mobility tax and immigration services business to Clayton Dubilier Rice CDR fundsUpon. Learn all about Prince William County real estate tax. During the July 14 meeting the Prince William Board of County Supervisors voted to defer payments for the first half of the real estate taxes due on July 15 2020 until Oct.

Business License Renewals Due. Provided by Prince William County. July 6 2020.

FOR ALL DUE DATESif a due date or deadline falls on a Saturday Sunday or. Personal Property Taxes and Vehicle License Fees Due. The assessments office mailed the 2021 assessment notices beginning march 9 2021.

Prince William County Real Estate Taxes Due July 15 2022. If you have not received a. Estimated Tax Payment 2 Due Treasurers Office July 1.

Prince William County personal property taxes for 2021 are due on October 5 2021. A 10 late penalty and 10 interest per annum is added for any. State Income Tax Filing Deadline State Estimated Taxes Due Voucher 1 June 5.

Gross Receipts Declaration for Professional and Occupational License BPOL for Tax Year 2020 were due by April 30 2021. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. The due dates are july 28 and december 5 each year.

4379 ridgewood center drive suite 203 prince william va 22192. Business License Tax Due Treasurers Office.

Voices Meals Tax In Prince William Doesn T Make Sense For Families

Prince William County Real Estate Taxes Due July 15 2022 Prince William Living

3215 Prince William Dr Fairfax Va 22031 Mls Vafx2052430 Redfin

Updated Woodbridge Area Eyed For New Commanders Stadium Appears To Overlap Commuter Lot Part Of High School Site News Princewilliamtimes Com

Editorial Nothing Less Than Prince William County S Future At Stake Headlines Insidenova Com

The Sheriff Of Nottingham In Prince William County

Prince William County Considers Land Use Changes That Encourage Sprawl The Piedmont Environmental Council

Job Opportunities Sorted By Job Title Ascending Prince William County

Prince William County Weighs Proposals That Could Accelerate Data Center Growth

County Supervisors Approve Fiscal 2022 Budget Tax Rates Wupw News

Prince William County Government

Prince William County Government

Prince William County Weighs Proposals That Could Accelerate Data Center Growth

Prince William County Va Businesses For Sale Bizbuysell

A Dozen Western Prince William Landowners Pitch 800 Acre Digital Gateway Near Battlefield News Princewilliamtimes Com

Deadline Extended To Pay Real Estate Taxes For Second Half Of 2020 Prince William Living